A promise to business members

Credit unions’ consultative approach benefits small businesses’ financial health.

Access to credit

Borrowing and credit are especially important for business owners navigating the current economic environment.

Access to affordable credit is a key driver of personal financial well-being for business owners and a key driver of the well-being of the businesses they operate.

Federal Reserve data shows that banks have been tightening business loan underwriting standards for two years, and recent results show an acceleration in that activity.

In fact, at the end of the third quarter of 2023, the net percentage of domestic banks tightening standards for commercial and industrial loans to small companies rose to 49%, the third-highest reading in the past 30 years.

However, the voter poll update shows 89% of business-owner households who are credit union members say it’s easy to get a loan at their credit union, and a similar percentage (88%) say they can get a low-cost loan at their credit union.

In contrast, only 71% of business owners who use other financial institutions say it’s easy to get a loan, and only 72% indicate they can get a low-cost loan.

In addition to examining issues directly related to financial well-being, the voter poll also considers several factors that are indirectly connected to the concept.

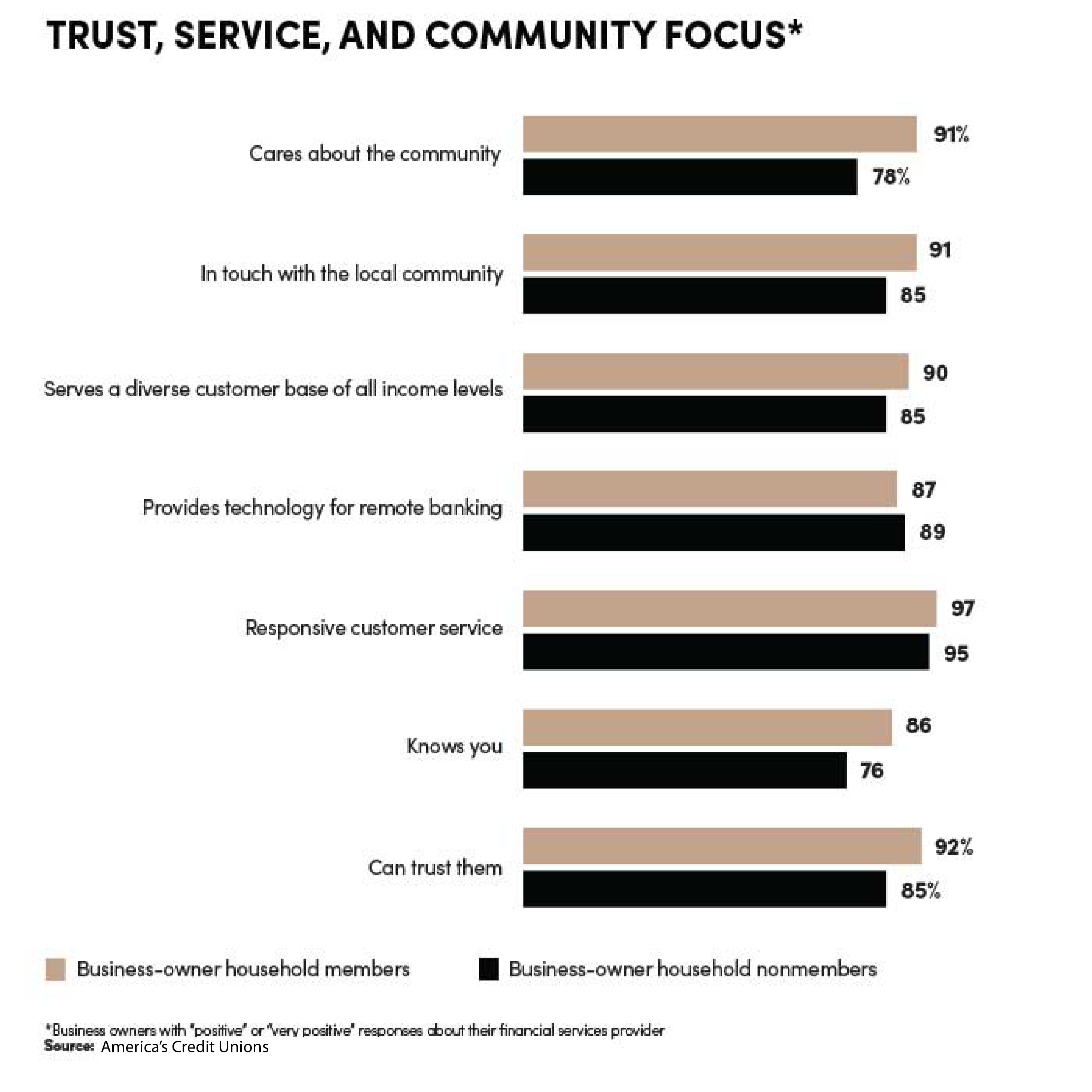

Trust, for example, is critically important. Responsiveness, too, is central to delivering on the promise of financial health.

Exponential growth in competition from unregulated fintechs looms large. Digitization and the need to reduce friction are the cornerstones of almost any strategic conversation.

In the financial services arena, nudging consumers at exactly the right moment is critically important to favorable outcomes.

In addition, business owners seek relationships with financial organizations that have an obvious commitment to both themselves and their broader community. This is expressed in corporate mission and values, daily operations, and personal interactions.

The National Voter Poll investigates each of these foundational elements because they’re associated with building deep, meaningful, and long-standing relationships.

The number of items we review isn’t extensive, but we see these elements as providing important clues around institutional capability and commitment to improving financial health.

Credit union members in business-owner households are generally more likely than their nonmember counterparts to view each of these ancillary measures in a positive way.

Slower growth ahead

Credit unions started 2023 in generally good financial shape, and nearly all should have the resources to continue to serve in meaningful ways.

As the Federal Reserve continues to aggressively combat inflation, America's Credit Unions' economists expect slower economic growth. This will undoubtedly lead to more obvious labor market disruption and give rise to associated stress in member business operations and finances.

Even so, credit unions routinely shine in tough economic environments because they remain engaged, and actively help members navigate financial disruptions.

Conversely, for-profit financial providers have a fiduciary obligation to protect shareholder value, so they’re much more likely to turn potential business borrowers away to defend bank earnings and quarterly shareholder dividend payments.

Those differences are obvious in the marketplace today.

While economic dislocations can be both disruptive and challenging, they also represent an important opportunity for credit unions to meaningfully engage with business owners.

Advocacy around policies that improve access and expand member business lending opportunities is important.

Increasing consumer awareness by promoting the credit union difference will pay big dividends, both for business owners and for the communities they serve.

MIKE SCHENK is chief economist and vice president of data and research at America's Credit Unions. Contact him at mschenk@americascreditunions.org.