A promise to business members

Credit unions’ consultative approach benefits small businesses’ financial health.

The nation's 30 million small businesses account for almost half of U.S. economic activity. They create two-thirds of net new jobs, and they're big drivers of business diversity, innovation, and overall competitiveness.

Collectively, small businesses are the foundation of healthy, vibrant communities across the country.

Most small business owners, however, are increasingly worried about the future. The combination of stubbornly high inflation, soaring market interest rates, challenges with hiring and retaining employees, and the looming possibility of recession has taken its toll.

The National Federation of Independent Business reports its Small Business Optimism Index has been on a broad declining trend. Index readings below the 49-year average of 98 have been obvious for nearly two years.

A recent refresh of the 2023 America's Credit Unions National Voter Poll confirms these broad concerns and uncovers significant challenges and dislocations.

For example, survey results reveal that only 45% of business-owner households say their income is keeping up with the cost of essentials like gas, groceries, and housing.

Behavioral signs of financial challenges in business-owner households also are easy to see. When compared to all households, business-owner households are much more likely to use alternative financial services providers to meet financial obligations. These include rent-to-own companies, payday loan providers, pawnshops, and auto title firms.

They’re also more likely to self-identify as financially unhealthy.

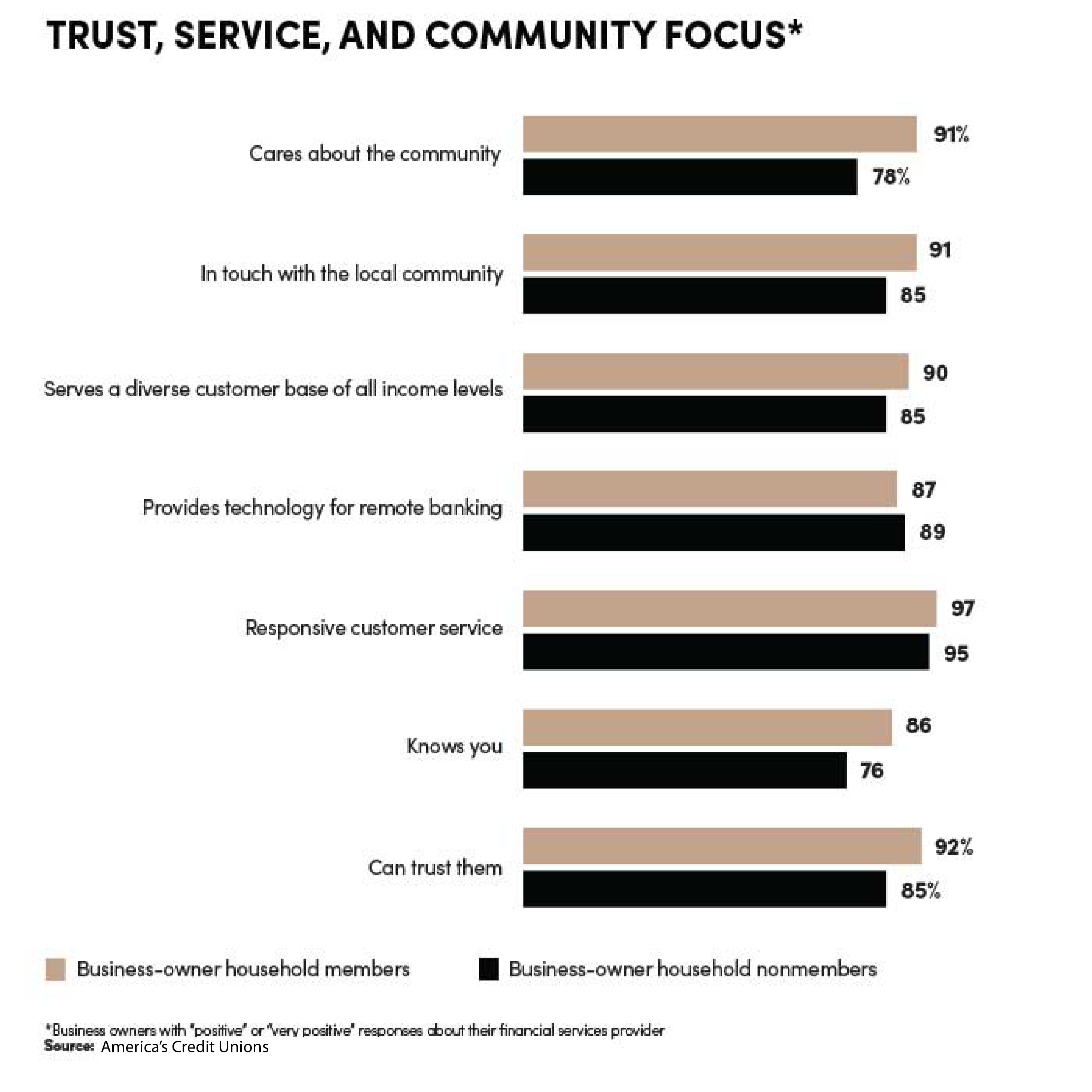

The challenges are obvious. However, survey results unambiguously reveal that business-owner households who are members view their credit unions much more favorably than their nonmember counterparts view the for-profit banks and other providers they use. This is true across nearly all performance metrics we evaluate.

The differences we find appear to stem from credit unions’ more consultative approach, more business-friendly pricing, thoughtful products and services, and an overall sense of trust that financial cooperatives foster in business-owner households.

For example, business-owner household respondents who are credit union members are 1.4 times more likely than nonmember business-owner households to say they’ve received personalized financial education/counseling at their financial institution. Responses show that credit union members have acted based on the advice they received at their credit union, and have established a financial buffer to shield them during tough times.

Business-owner households that don’t use credit unions are twice as likely as their counterparts who are members to say they haven’t established a financial buffer of at least $500 to meet unexpected expenses.

Not surprisingly, business-owner households who are members are 1.3 times more likely than nonmembers to say they’re very positive their financial institution has improved their financial health.

Polling results detail similar differences across most of the 11 other dimensions related to financial health, including those related to trust, service provision, and community focus.

Next: A promise to members

A promise to members

Credit unions exist to improve members' financial wellness. The specific wording varies, but the essence of this commitment is codified in each credit union’s bylaws.

Credit unions have delivered on that promise since their formation in the U.S. in the early 1900s. Their unique, not-for-profit, member-ownership structure produces obvious favorable outcomes—especially during times of crisis.

The National Voter Poll uncovers a meaningful, measurable credit union difference around financial resilience and financial wellness today.

More than 92% of credit union members in business-owner households say their credit union cares about their financial health.

Credit union members who are business owners are 1.4 times more likely than their counterparts who are nonmembers (by a 48% to 35% margin) to respond very positively to this idea.

Members in this demographic group also are more likely than nonmembers to say their credit union has positively impacted their financial health.

Polling shows that this feeling credit union members enjoy—of being cared for and looked after by trusted advisers—is rooted in members’ economic outcomes. A sizable percentage of members in business lending households (88%) say their credit union has improved their financial health.

Credit union members are 1.3 times more likely than nonmembers (by a 43% to 34% margin) to be passionate about this, saying they’re very positive about the ways their institution has improved their financial health.

Compared to nonmembers, members in business-owner household also are more likely to self-report that they’re financially very healthy.

In some respects, these key differences aren’t terribly surprising. Financial wellness has an obvious connection with financial education and financial literacy, and credit unions excel on this front.

NCUA Profile Report data shows that 86% of members have access to financial education and literacy programs at their credit unions.

However, financial health and wellness depend on much more than education and literacy. The Financial Health Network identifies four key components of financial health: spending, saving, borrowing, and planning.

The National Voter Poll draws on these concepts, exploring how consumers feel about their finances and how they behave. Across the board, the survey results show that business-owner households that are credit union members fare better than their counterparts who are nonmembers.

Next: Access to credit

Access to credit

Borrowing and credit are especially important for business owners navigating the current economic environment.

Access to affordable credit is a key driver of personal financial well-being for business owners and a key driver of the well-being of the businesses they operate.

Federal Reserve data shows that banks have been tightening business loan underwriting standards for two years, and recent results show an acceleration in that activity.

In fact, at the end of the third quarter of 2023, the net percentage of domestic banks tightening standards for commercial and industrial loans to small companies rose to 49%, the third-highest reading in the past 30 years.

However, the voter poll update shows 89% of business-owner households who are credit union members say it’s easy to get a loan at their credit union, and a similar percentage (88%) say they can get a low-cost loan at their credit union.

In contrast, only 71% of business owners who use other financial institutions say it’s easy to get a loan, and only 72% indicate they can get a low-cost loan.

In addition to examining issues directly related to financial well-being, the voter poll also considers several factors that are indirectly connected to the concept.

Trust, for example, is critically important. Responsiveness, too, is central to delivering on the promise of financial health.

Exponential growth in competition from unregulated fintechs looms large. Digitization and the need to reduce friction are the cornerstones of almost any strategic conversation.

In the financial services arena, nudging consumers at exactly the right moment is critically important to favorable outcomes.

In addition, business owners seek relationships with financial organizations that have an obvious commitment to both themselves and their broader community. This is expressed in corporate mission and values, daily operations, and personal interactions.

The National Voter Poll investigates each of these foundational elements because they’re associated with building deep, meaningful, and long-standing relationships.

The number of items we review isn’t extensive, but we see these elements as providing important clues around institutional capability and commitment to improving financial health.

Credit union members in business-owner households are generally more likely than their nonmember counterparts to view each of these ancillary measures in a positive way.

Slower growth ahead

Credit unions started 2023 in generally good financial shape, and nearly all should have the resources to continue to serve in meaningful ways.

As the Federal Reserve continues to aggressively combat inflation, America's Credit Unions' economists expect slower economic growth. This will undoubtedly lead to more obvious labor market disruption and give rise to associated stress in member business operations and finances.

Even so, credit unions routinely shine in tough economic environments because they remain engaged, and actively help members navigate financial disruptions.

Conversely, for-profit financial providers have a fiduciary obligation to protect shareholder value, so they’re much more likely to turn potential business borrowers away to defend bank earnings and quarterly shareholder dividend payments.

Those differences are obvious in the marketplace today.

While economic dislocations can be both disruptive and challenging, they also represent an important opportunity for credit unions to meaningfully engage with business owners.

Advocacy around policies that improve access and expand member business lending opportunities is important.

Increasing consumer awareness by promoting the credit union difference will pay big dividends, both for business owners and for the communities they serve.

MIKE SCHENK is chief economist and vice president of data and research at America's Credit Unions. Contact him at mschenk@americascreditunions.org.