This month, CUNA News highlights innovations and developments in lending. During June, our Lending 2022 special report, sponsored by Cornerstone Advisors, will examine the lending and economic outlook for the rest of the year, how online auto retailers affect credit union auto lending, end-to-end digital mortgages, creative loan ideas, loan growth and inclusion, and more.

We also want to share your lending opportunities and challenges. Using the form on this page, tell us about your biggest lending opportunity, your biggest lending challenge, an example of a successful loan program, and advice you’d offer other lending leaders.

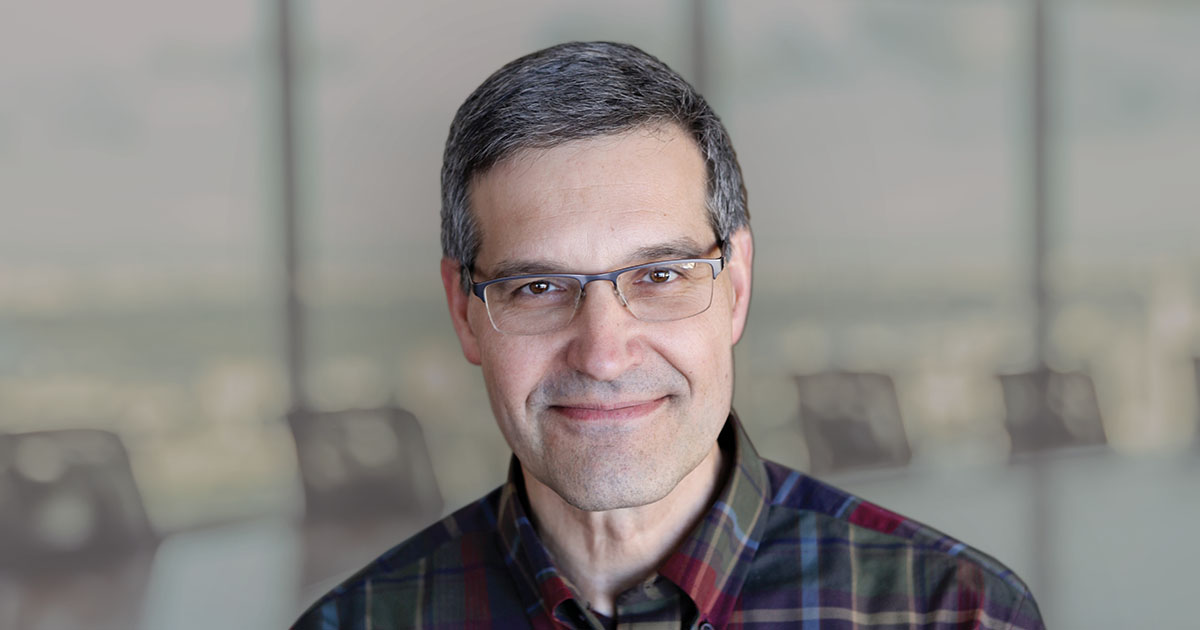

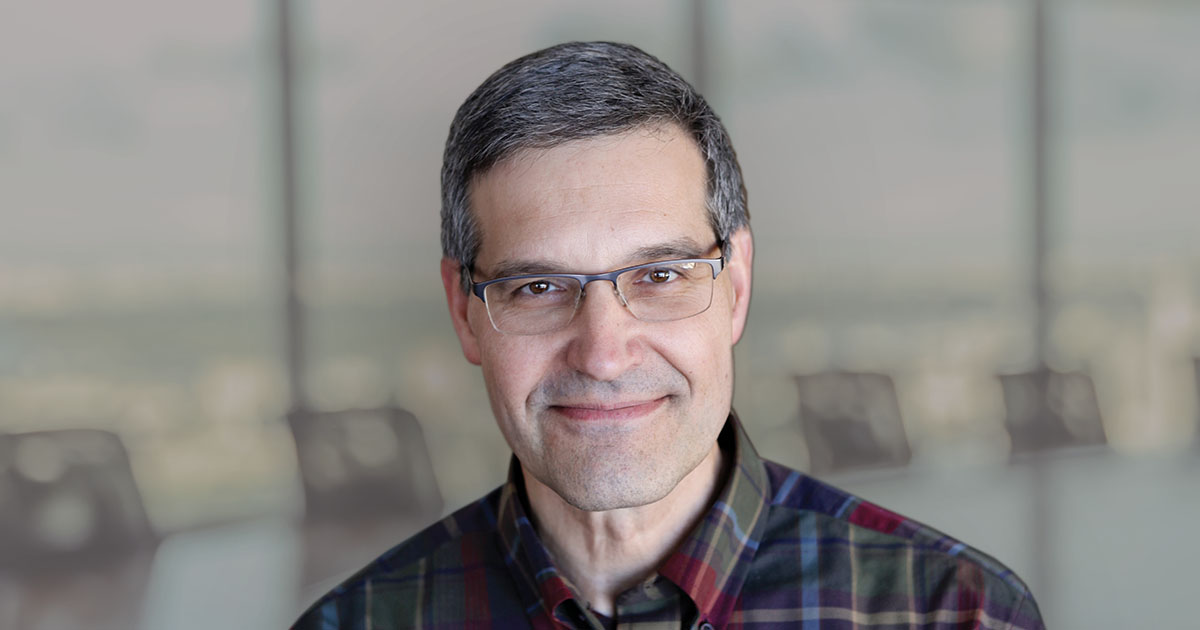

PODCAST: What’s in store for the economy and lending?

CUNA Chief Economist Mike Schenk discusses factors at play in the economy.

Speed counts in today’s mortgage market

Fintechs have reshaped the competitive environment.

Financial Inclusion Mortgage boosts home access

Initiative benefits low-income borrowers, first responders, veterans and educators.

Auto lending in an online world

Ent Credit Union provides members what they need no matter the platform.

A faster, cheaper mortgage process

Beth Eller believes eClosings are the future of mortgages.

Schenk: Expect above-average loan growth

Pent-up demand and a strong labor market will lead to 8% growth in 2022, says CUNA’s chief economist.

Financing neighborhood electric vehicles

South Bay Credit Union partners with dealer to offer auto loans for street-legal golf carts.

‘Impact Loan’ demonstrates concern for staff

Program provides tangible proof that CHROME Federal ‘has employees’ backs.’

Fee-based product meets Muslim financing needs

Credit union creates home ownership financing product with support from a local imam.

Navigating a competitive lending market

Latonya Allen builds on an early start in the credit union system.

Fishing program hooks a whopper in boat loans

Members take the bait with Bass Cash promotion..

Q&A with Homer Renteria

PSECU chief revenue and lending officer examines current opportunities, challenges.

Countering payday lenders

Loan products meet community needs and allow Afena FCU to thrive, says CEO Karen Madry.

Using data to fine-tune collections

WSECU builds model to score loans, determine best course of action.

Green lending generates growth

Clean Energy Credit Union thrives by shifting members’ energy use.