Next-level marketing

Marketers share insights into their award-winning community service, financial education, use of art, and email marketing.

Financial education

SAFE Federal Credit Union in Sumter, S.C., won the Best of Show Award for its SAFE Cents Financial Education initiative. The video series aims to improve members’ financial well-being.

“Financial education has been important to us for a long time,” says Bruce Copeland, vice president of marketing at the $1.8 billion asset credit union. “But over the past 18 months, we’ve elevated it into an integral part of SAFE Federal’s brand, mindset, and culture.

“Almost everyone in the industry has a section of their website devoted to financial education,” he continues. “There’s nothing wrong with that, but to really make a difference we needed to up our game.”

The SAFE Cents video series provides a fun approach to delivering practical information on financial topics such as credit scores and debt management.

“We pulled together information people need about financial services, their account, and how to manage it—real-life, usable stuff put together in a way that’s entertaining enough to make people want to watch,” Copeland says. “It felt like the right topic at the right time. Not being super serious and having some fun with it felt like the right tone.”

The credit union’s marketing and advertising teams worked with the on-camera talent to develop eight SAFE Cents videos. It shot the videos, which range from 45 seconds to two and a half minutes in length, over the course of two days.

“If you want to actively engage folks, video is the way to go. The shorter the better,” Copeland says. “Video is a perfect medium if you want to clearly show examples of what you’re trying to communicate.”

Click to enlarge. SAFE Federal Credit Union uses the SAFE Cents video series to deliver financial lessons in a fun format.

The marketing team’s job wasn’t finished after the series’ August 2022 launch. They worked to make sure they were seen by as many people as possible.

The series is advertised on broadcasts and 30-second teasers, encouraging listeners to visit SAFE Federal’s website or YouTube channel. The YouTube videos average 60,000 views monthly, while digital channels advertising the videos receive roughly 119,000 views per month. Website pre-roll teasers account for another 40,000 views each month.

“It’s easy to put good material together,” Copeland says. “But unless you deliver it in a way that engages folks, they aren’t going to take part.”

At the same time, the credit union doesn’t try to beat members over the head with financial education.

“When it begins to have the feel of a sales pitch, you run the risk of undermining what you’re trying to get across,” he says. “We try to do it in a way that doesn’t come across as heavy-handed or condescending. Hopefully, it’s entertaining.”

Copeland says members watch most SAFE Cents videos in their entirety, garnering about two million total views. “That tells me that members are staying with it and finding value in it,” he says. “We hope they put it to good use.”

Brilliant use of art

TRUE Community Credit Union in Jackson, Mich., won a Brilliant Use of Art Award for the “thought-provoking approach to design and execution” in its “Digital Refresh-Upgrade to Digital Banking Platform” campaign.

Chrissy Siders, president/CEO at the $721 million asset credit union, says the digital refresh stemmed from significant changes to the credit union.

At the start of the pandemic, “we changed our charter, changed our name, merged, and changed our name again,” she says.

Even before these changes, the credit union’s leaders had identified a need to improve their digital platforms. “Our app at the time was going down almost every payday Friday,” Siders says, which put the credit union’s reputation at risk. “We needed to think about what we had to do to show up in the way our members would expect us to.”

Once the contract with its previous provider expired, TRUE Community set out to give members better service and more options. At the same time, it wanted to compete in an increasingly technologically advanced marketplace.

More than just offering members products and services, the marketing team set out to develop an app that brought the credit union to life, Siders says.

Whether members use the website, app, or branch, they should see “a constant, seamless message and the same beautiful use of our brand and art,” she says.

Siders believes service is no longer a differentiator. “What differentiates you is having a clear purpose, mission, vision, and values—and living them every day.”

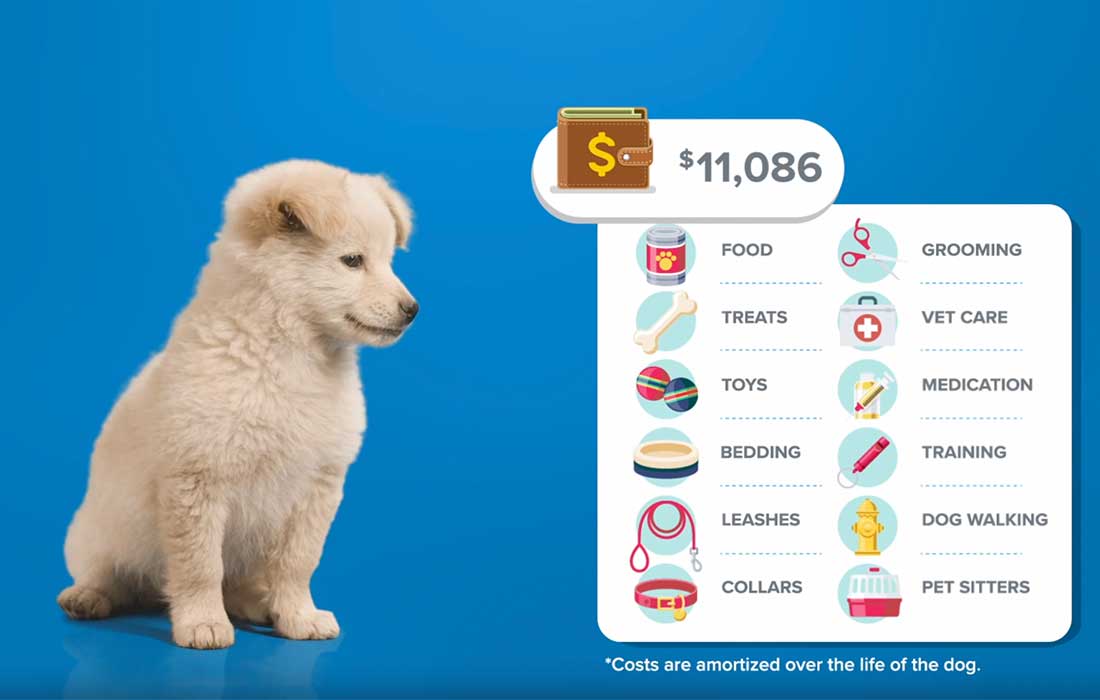

Therefore, the credit union designed a digital campaign that was fun, using a pet theme to develop a lighthearted feel everyone could rally around.

Next: 'The right people in the right roles'